Shopping Addiction: Signs, Risks, and How to Break Free

- Published:

When you feel upset or sad, do you go shopping to feel better? If so, you might have a shopping addiction. As an entrepreneur coach, I want to help you with this problem before it leads to debt or bankruptcy. In this article, we’ll explain what shopping addiction is and discuss treatment options.

First, let’s define shopping or retail addiction.

Like all addictions, it is not uncommon to have co-occurring disorders. For example, in addition to a shopping addiction, you may also suffer from obsessive-compulsive disorder or post-traumatic stress disorder.

Denise G. Lee Tweet

What is a Shopping Addiction?

Shopping addictions, like all addictions, come from a strong urge to use people, substances, or things (like money) in an unhealthy way. This addiction shows a dependency on shopping and money.

Addictions don’t appear suddenly. They develop over time, sometimes by observing and copying family members.

Also, addictions rarely happen with other stuff happening. It’s common for addictions to occur alongside other disorders. For example, a person with a shopping addiction might also have obsessive-compulsive disorder (OCD) or post-traumatic stress disorder (PTSD).

Shopping addiction is more common than you might think.

You or someone you know might be struggling with this problem. Research from 2006 showed that up to 16% of Americans deal with compulsive shopping. During the COVID-19 pandemic, high-income people were found to be more likely to spend compulsively.

Signs Your Shopping is Getting Out of Control

It’s easy to get caught up in shopping, especially with so many tempting offers and influencers online. But sometimes, spending can get out of hand without you realizing it.

Here are some signs that your shopping might be becoming a problem, along with real-life examples of how people manage to hide their purchases or stealth shop both at home and in their work lives.

Hiding Purchases: Sneaking items into the house or car to avoid detection. Example: Take Anna, who hides new clothes in the coat closet, behind furniture, or in the laundry basket to keep her spending secret from her family.

Feeling Guilty: Experiencing guilt or shame about your shopping habits. Example: Despite earning her own money, Anna feels guilty about how much she spends and doesn’t want her husband to know about her new purchases.

Manipulating Financial Records: Altering or hiding financial information to conceal spending. Example: Ben hides his purchases by leaving them in the car or changing financial records to keep his spending a secret.

Changing Into New Purchases Before Entering the House: Wearing new items immediately to make them seem old. Example: Lily changes into new shoes in her car to make them look like they’ve been in her wardrobe for a while.

The relief that comes from retail therapy can soon become a pain if you can't manage the stress that caused it.

Denise G Lee Tweet

Using Stealth Techniques: Employing tactics to smuggle new items into the house. Example: Samantha uses gym bags or dry-cleaning bags to bring in new clothes unnoticed, delaying arguments with her husband.

High-Pressure Influences: Feeling pressured to buy things due to online influencers, even when it strains the budget. Example: Tina buys items she sees promoted by influencers online, even when she can’t really afford them.

Timing Large Purchases with Other Big Expenses: Timing purchases to coincide with other significant bills to mask the spending. Example: John times his luxury shopping with big tax or insurance payments so his partner doesn’t question the high credit card bill.

Using Separate Accounts or Payment Methods: Utilizing separate credit cards or buy-now-pay-later services to avoid detection. Example: Mia uses her own credit card for luxury purchases to keep them hidden from her partner.

Other Signs of Compulsive Shopping

Cutting Off Price Tags: Removing tags and washing new clothes before wearing them to make them appear old. Example: Lisa cuts price tags off new clothes and washes them before wearing to make them seem like they’ve been owned for a while.

Hiding Purchases in Unusual Places: Storing new items in unusual spots to avoid detection. Example: Sara hides new shoes in her son’s toy box to keep them secret from her partner.

Using the Office for Deliveries: Having items shipped to work instead of home to avoid questions. Example: Paul has his custom-made shirts delivered to his office and claims they are old when asked by his wife.

Sending New Items to the Dry Cleaner: Sending new purchases to the dry cleaner before bringing them home to avoid suspicion. Example: Mark sends new shirts to the dry cleaner and brings them home wrapped in cellophane, so his wife won’t notice they are new.

How a compulsion can spiral into an addiction

Here is an illustration that may help you understand how a compulsion to avoid pain can lead addictive tendencies.

Picture this: You receive terrible news about something significant in your life. What is your first action? Do you:

- Call a friend or family member and talk about the issue?

- Take a walk and clear your head?

- Write out your plan of action?

- Open up your phone and visit a website or some social media site to purchase random things because it was a special deal only available for a limited time?

“Accidentally” doom scrolling on Amazon or Etsy

Visiting a website to shop didn’t happen by accident. You might have found comfort scrolling, then clicking, and feeling satisfied buying things. But the relief that comes from retail therapy can soon become a pain if you can’t manage the stress that caused it.

When someone has a shopping addiction, their life can feel confusing and out of control. Next, let’s talk about how shopping addiction can harm us.

Consequences of Shopping Addiction

Shopping addiction, like other addictions, involves an unhealthy relationship with people, places, and things (like money).

Here are some signs that you or someone you know might have a shopping addiction:

- Buying things that are never used or worn

- Forgetting about expensive purchases

- Maxing out credit cards

- Frequently taking money from retirement or savings accounts

- Borrowing money from family and friends and being unable to pay it back

- Buying vacations and luxury items without a plan to pay for them

While social media and TV shows often praise “retail therapy,” overspending can have serious consequences. Influencers who encourage us to buy more are not responsible for paying our bills.

Compulsive shopping or shopping addiction is a serious issue that shouldn’t be ignored. Spending money on things you can’t afford due to pressure from others or yourself can cause stress and trauma.

And in order to heal financially and emotionally, we need to understand the connection between trauma and addiction. The next section will discuss this in more detail.

The Link Between Shopping Addiction and Past Trauma: What You Need to Know

First, let’s define trauma. Financial trauma comes in two forms: acute (a specific moment in time) or chronic (meaning that it occurs over a long period of time).

Acute Financial Trauma

- Unexpected health crisis for you or a loved one

- Home is destroyed or you are forced to migrate

- Sudden job loss or unexpected unemployment

- Major financial loss due to scams or fraud

Chronic Financial Trauma

- No clear money manager or comptroller in your family

- No budget or not following your budget

- Long-term financial instability, such as growing up in poverty

- Chronic debt and ongoing financial stress

- Consistent underemployment or inability to find stable work

How Trauma Can Lead to Shopping Addiction

Here are some examples of how trauma can lead to shopping addiction:

- Emotional Escape: Someone who grew up with money problems might shop to escape feelings of not being good enough and fear of not having enough.

- Control and Empowerment: After losing a job, a person might shop to feel in control and powerful again.

- Comfort and Reward: Someone who was neglected financially as a child might shop to comfort themselves and reward their hard work, trying to fill the emotional gaps from their past.

- Social Acceptance: A person who was bullied or excluded because of money issues might shop a lot to buy things they think will help them fit in or be accepted.

- Temporary Relief: For those who lost a lot of money, shopping can give short-term relief from the stress and worry linked to their loss.

- Avoiding Painful Memories: Shopping can distract people who want to avoid thinking about painful memories related to their financial trauma.

Just like there is not a one-size-fits-all cause for trauma, there is also not a universal solution for healing. Keep trying different approaches until you find one that works for you.

Denise G. Lee Tweet

Help For Compulsive Shoppers

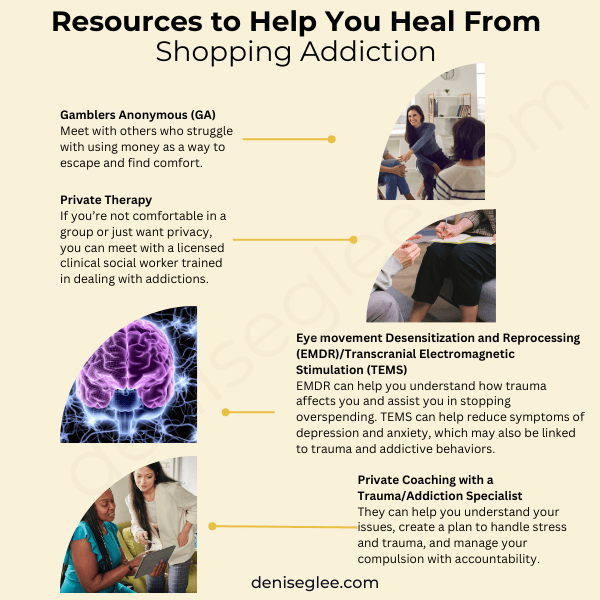

If you or someone you care about is a has a shopping addiction, here are some resources that can help:

Gamblers Anonymous (GA)

GA, based on the principles of Alcoholics Anonymous, is a great resource for those with a shopping addiction. You can meet with others who struggle with using money as a way to escape and find comfort. There are meetings worldwide and online. Find a nearby location or online meeting here.

Private Therapy

If you’re not comfortable in a group or just want privacy, you can meet with a licensed clinical social worker trained in dealing with addictions. There are also may be experts in your church or religious organization who may be able to help you or someone you know.

Eye movement Desensitization and Reprocessing (EMDR) or Transcranial Electromagnetic Stimulation (TEMS)

Addictions often stem from underlying trauma. Eye Movement Desensitization and Reprocessing (EMDR) can help you understand how trauma affects you and assist you in stopping behaviors like overspending. Look for a trained EMDR therapist near you.

Transcranial Electromagnetic Stimulation (TEMS) is another therapy that uses magnetic fields to stimulate specific areas of the brain. This can help reduce symptoms of depression and anxiety, which may also be linked to trauma and addiction.

Private Coaching with a Trauma/Addiction Specialist

A trauma-informed coach can help you understand your issues, create a plan to handle stress and trauma, and manage your compulsion with accountability. As a life coach specializing in trauma and addictions, I can help you or you can work with other professionals mentioned above.

Important Note: Just as there isn’t a single cause of trauma, there isn’t a single solution for healing. Keep trying different approaches until you find what works for you.

The image below summarizes resources to help you or someone you care about. Next, I will share my final thoughts.

Final Thoughts

While you may feel embarrassed or scared about a potential retail addiction, please give yourself a pat on the back! It takes a lot of courage to admit that things aren’t good.

Also, remember, getting better takes time, and it’s okay to try different ways until you find what helps you most. Don’t be afraid to ask for help, and know that lots of people are here to support you on your journey to feeling better and stronger.

And if you want to work with me on our healing journey, click here!

Dig Deeper: Listen to this podcast episode from my entrepreneur podcast about shopping addiction or click on the play button below.